September 30, 2019

Covered in Circular 15/3 of the Commissariat aux Assurances, dedicated shared funds known as ‘umbrella’ funds enable multiple subscribers to participate in a dedicated joint fund.

But what is so special about it that merits an article from us?

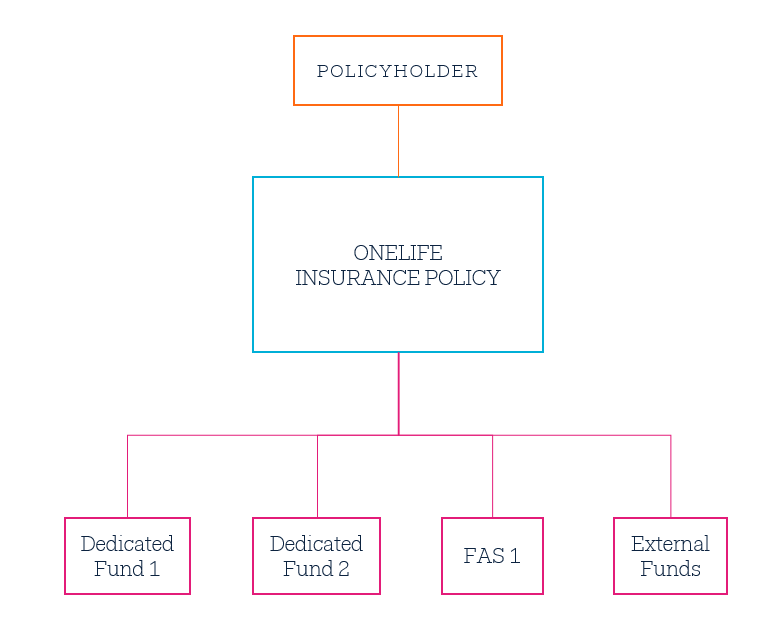

The principle means that an assurance contract may sustain multiple dedicated funds, collective internal funds and even external funds within a single structure.

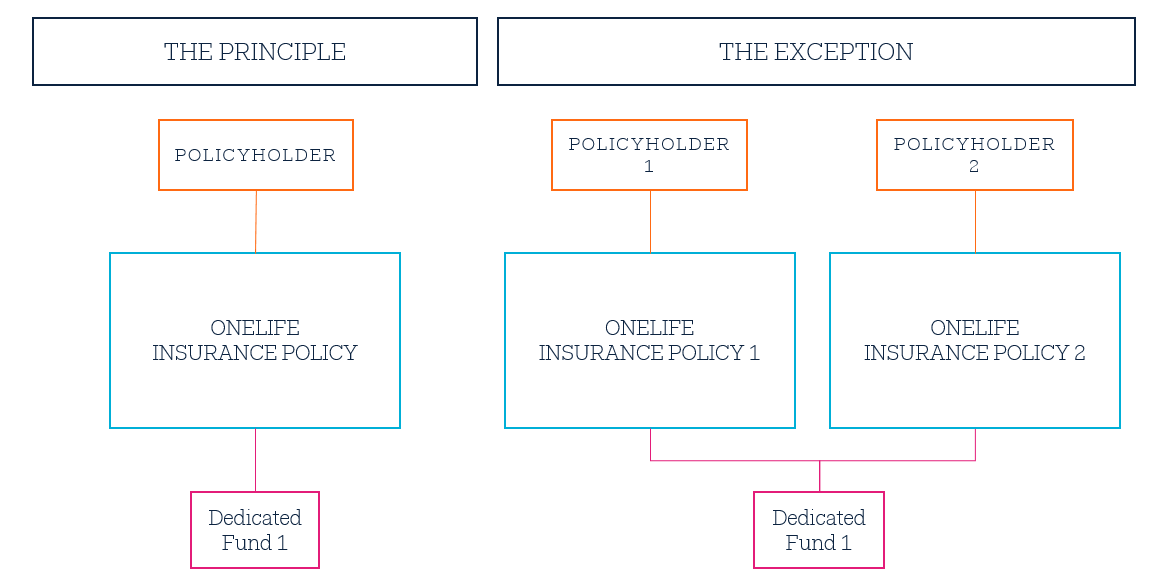

However, the contrary is normally prohibited! A dedicated fund may only sustain a single contract, in principle.

By way of exception, OneLife may request authorisation from the Commissariat aux Assurances to open a dedicated umbrella fund if certain conditions are met.

So what are the advantages of a dedicated umbrella fund compared to a dedicated single fund? What conditions must be met to be able to enjoy its benefits?

1. The dedicated umbrella fund in brief

Are you fortunate enough to have significant assets?

Are you, your children, parents or other family members highly mobile and dispersed over a wide geographical area?

Are you looking for an optimised inter-generational inheritance vehicle?

In short, the dedicated umbrella fund is made for you

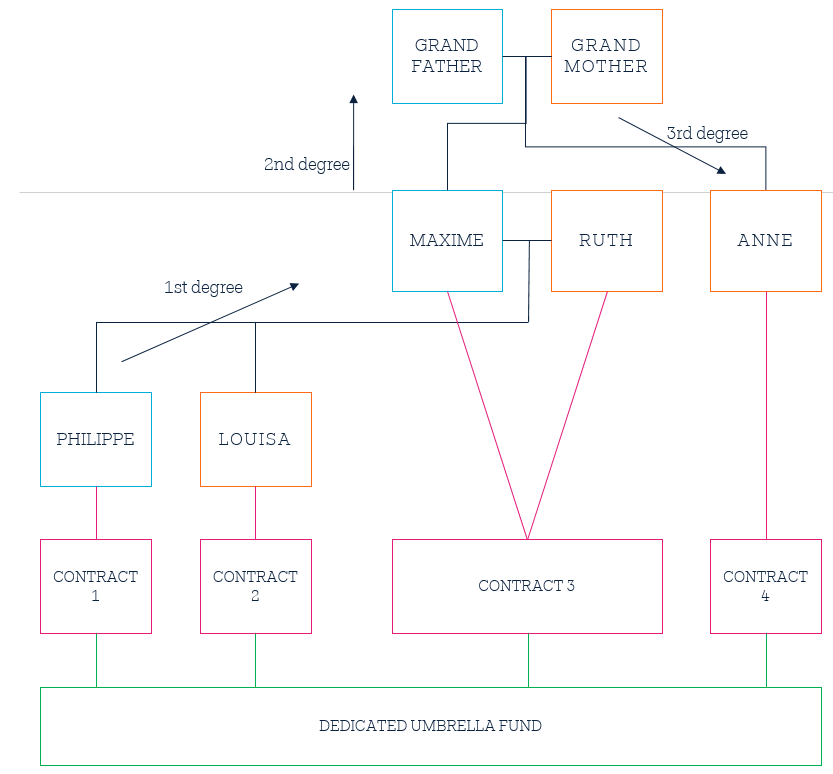

Let us take the example of Maxime and Ruth, a young couple of Belgian retirees who are always planning ahead. Maxime and Ruth wish to optimise the management of their financial assets in order to leave a legacy one day to their children, Philippe and Louisa.

Philippe is a passionate IT entrepreneur living in the UK who wants to sell his start-up, realise the proceeds of the sale and turn to another project. Louisa is currently finishing her Erasmus studies in Spain.

Maxime has a sister, Anne, who doesn’t have children, but loves Maxime’s children as if they were her own. Anne invested very early on in real estate and has built her wealth around it. Now she would like to enjoy life in her villa in Provence and ultimately pass on her wealth to Philippe and Louisa.

Maxime has just seen his advisor who recommends that he and his family should take out assurance contracts linked to a dedicated umbrella fund.

2. The conditions to be met in order to enjoy the benefits of the umbrella fund

Being an exception, there are a number of conditions to be able to open such an umbrella fund:

1. There must be multiple contracts subscribed by one or more different subscribers, linked to a dedicated fund;

2. If there are multiple different subscribers, they must be linked by matrimonial ties (married) or close family ties (up to the 3rd degree of kinship) in a direct or collateral line (see below);

3. The management policy of the dedicated umbrella fund must conform with the profiles and strategies of each of the subscribers’ contracts;

4. Each of the contracts linked to the dedicated umbrella fund must meet minimum criteria in terms of capital and premiums in order to be linked to the dedicated umbrella fund;

5. Implementation of such a dedicated fund is subject to authorisation from the Commissariat aux Assurances.

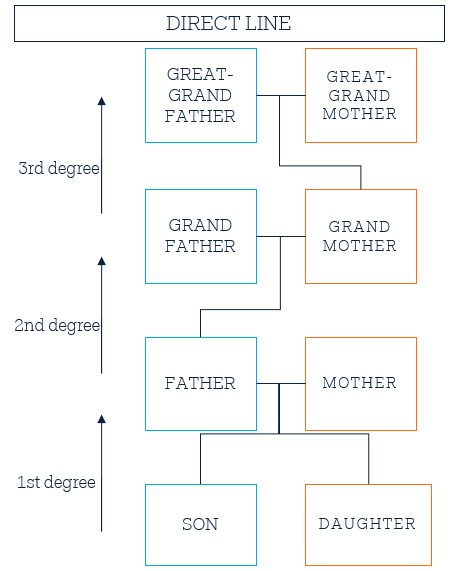

The 2nd condition requires further explanation. Close family ties can be in a direct or collateral line, i.e. between one person and their ascendants or descendants up to the 3rd degree:

The 2nd condition requires further explanation. Close family ties can be in a direct or collateral line, i.e. between one person and their ascendants or descendants up to the 3rd degree:

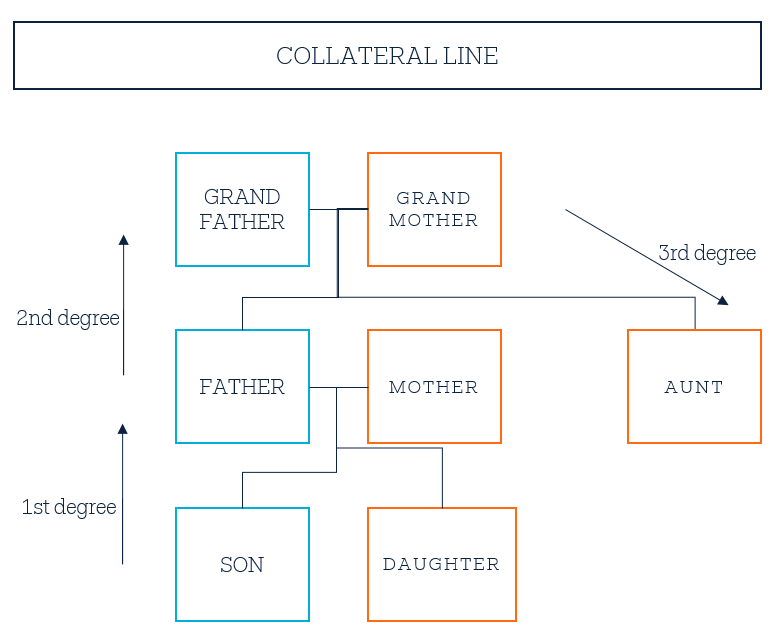

Or in the collateral line also up to the 3rd degree:

In the collateral line, you must go up to the common ascendants and count each degree (generation) in order to establish the degree of kinship. For example, a cousin occupies the 4th degree of kinship with the son in the above example.

We can therefore confirm that the idea of establishing a dedicated umbrella fund for Maxime, his wife, two children and sister is permissible!

3. Advantages

Implementation of this dedicated umbrella fund will enable the family to plan their succession using the life assurance contract. Furthermore, with ever more wealthy families being increasingly mobile, the dedicated umbrella fund can be placed solely under the prudential legislation of Luxembourg, even though the contracts issued are subject to different contractual, civil and tax rules in accordance with the place of residence of the policyholder.

Would you like more information? OneLife’s experts are there to help your or your clients’ wealth and estate planning.

![]() Jean-Nicolas GRANDHAYE : Corporate Counsel OneLife

Jean-Nicolas GRANDHAYE : Corporate Counsel OneLife

Additional reading:

-Life assurance: your estate management toolkit – The beneficiary clause: https://www.onelife.com/blog/life-assurance-your-estate-management-toolkit-episode-2/

-Life assurance: your estate management toolkit – Pledging life insurance policies as security: https://www.onelife.com/blog/pledging-life-insurance-policies-as-security/