June 17, 2020

A small enclave located between Germany, Belgium and France, Luxembourg has succeeded in differentiating itself in western Europe by its international openness.

Its stable political and fiscal environment, the robustness of its institutions, its budget surplus, its peaceful social climate and its multilingual and specialised workforce are among the attractions for investors from all over the world.

The Grand Duchy is financially solvent and is one of the rare countries to boast a triple A financial rating. It also has a modern legal and regulatory framework enabling it to adapt to change and maintain its competitiveness. In the current economic climate its very low level of debt will enable it to safely face up to the impact of the coronavirus pandemic on its economy.

Luxembourg tops several ranking tables in the financial sector:

- 1 investment fund centre in Europe and no.2 in the world after the United States.

- 1 in cross-border investment fund distribution worldwide

- 1 private banking centre in the eurozone

- 1 in Europe in listings of international transferable securities

- 1 in Europe in cross-border distribution of insurance products

In its latest annual report, the Commissariat aux Assurances (CAA), the Luxembourg insurance regulator, recorded 295 insurance and reinsurance companies based in the Grand Duchy.

Its neighbouring countries represent a significant proportion of the business: over 80% of insurance premiums collected annually come from cross-border life assurance policies taken out under the Free Provision of Services (FPS) regime. France, Italy, Belgium and Germany are the four leading clients of Luxembourg life assurance, with assets under management of over 120 billion euros. The insurance sector also extends outside the European Union, however, notably to Asia, North and South America and the Middle East, accounting for over 40% of all the assets present in Luxembourg.

Its neighbouring countries represent a significant proportion of the business: over 80% of insurance premiums collected annually come from cross-border life assurance policies taken out under the Free Provision of Services (FPS) regime. France, Italy, Belgium and Germany are the four leading clients of Luxembourg life assurance, with assets under management of over 120 billion euros. The insurance sector also extends outside the European Union, however, notably to Asia, North and South America and the Middle East, accounting for over 40% of all the assets present in Luxembourg.

This success can be explained by the capacity of Luxembourg policies to offer a multi-currency, multi-jurisdiction environment, investment flexibility, international portability, fiscal neutrality and, lastly, maximum security for investors.

On this last point, it is important to stress that the insurance business is strictly regulated and supervised by the CAA, a public institution under the authority of the Finance Minister. The CAA has a legal personality separate from that of the State and total financial autonomy. Its quintessential mission is to guarantee the protection of policyholders and beneficiaries.

The CAA monitors Luxembourg insurers closely and continuously; the latter are subject to rules relating to the solvency ratio but are also obliged to provide detailed quarterly reports and annual reports and to agree to in situ inspections.

The law of 7/12/2015 on the Luxembourg insurance sector modernises the law of 6/12/1991, which already contained these provisions, by transposing the European Solvency II Directive. It accentuates the transparency of the sector while preserving professional secrecy applicable to Luxembourg (excluding exceptions relating to combatting money laundering and the financing of terrorism).

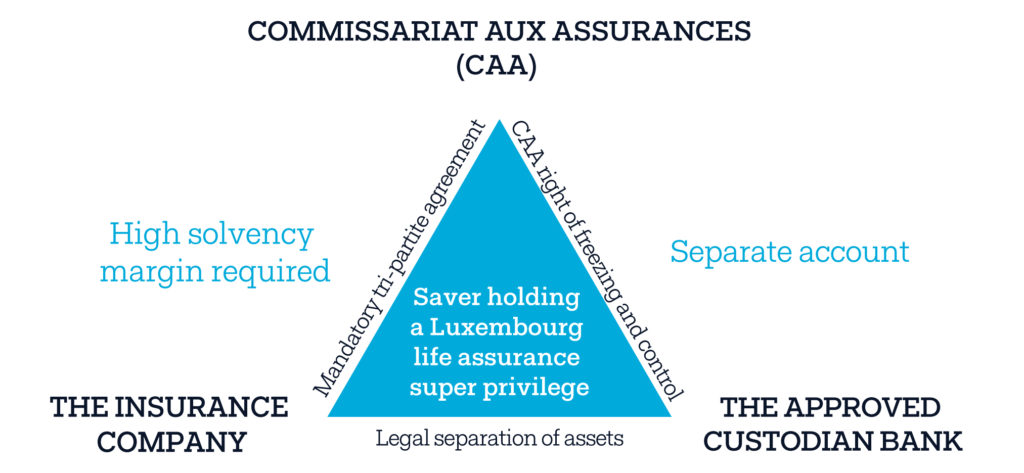

In this reassuring overarching economic, political, fiscal and legislative environment, policyholders benefit from a protection regime unique in Europe.

In detail, the primary argument is the separation of the insurer’s assets (free assets) from those of the clients (regulated assets), which means that they are separated legally and physically. The capital invested by clients within their life assurance policies represents the insurer’s commitments (or technical provisions) and must be deposited with an independent custodian bank approved by the CAA.

The CAA, the insurer and the custodian bank are bound by a tri-partite agreement which frames the assets deposited. The bank must also, itself, separate these “life assurance” assets from the bank’s other assets. Commonly referred to as the “Triangle of Security”, this mechanism enables the regulator to make all the checks provided for in law and to freeze the “life assurance” assets directly at the bank if it considers that the company clients’ interests are in danger due to a delicate financial situation.

The second argument is the “Super Privilege” held by the policyholder. The policyholder has a priority right overriding all the other privileged debtholders (State, Treasury, Social Security organisations, Employees) should the company go bankrupt to recover in first place the assets attributable to their insurance policy. The law of 10/08/2018 has, in this regard, reinforced the protection reserved for policyholders, offering the latter an unlimited guarantee of the deposits. Reciprocally, in the event of difficulties on the part of the custodian bank, the insurer may transfer their assets to another establishment approved by the CAA.

In short, Luxembourg insurance policies are highly valued. They constitute the cornerstone of wealth optimisation strategies for European and international investors.