April 30, 2019

What is the importance of the beneficiary clause in your life assurance contract?

What does it achieve and how should it be written?

How can you ensure that it meets clients’ needs?

How can you best advise your clients in order to meet their needs in terms of estate management and, especially, succession planning?

In order to answer these questions let us take a closer look at the beneficiary clause, which is to life assurance what your morning coffee is to a successful day: indispensable!

- So what is the purpose of the beneficiary clause?

Without a beneficiary clause, all the tax advantages of your life assurance contract fly out the window!

Even though the beneficiary clause does not undermine the validity of the life assurance contract, the favourable tax and civil treatment under the stipulation pour autrui (special provision conferring a benefit to a third party) of the life assurance contract will not apply, with the assets therefore returning to the estate without enjoying the benefits of the life assurance contract.

The stipulation pour autrui, the cornerstone of the life assurance contract!

The stipulation pour autrui is set out in Article 1205 of the French Civil Code and in Article 1121 of the Belgian Civil Code.

Extract from Article 1205 of the French Civil Code:

“Third-party stipulations are permissible.

One of the contracting parties, the stipulator, may call on another party, the promisor, to perform an undertaking for a third party, the beneficiary. The latter may be a future person but must be clearly identified or be able to be determined when the promise is carried out.”

Extract from Article 1121 of the Belgian Civil Code:

“One may similarly stipulate in favour of a third party, where this is the condition of a stipulation one makes for oneself or of a donation one makes to another. The person making the stipulation may no longer withdraw it once the third party has declared their intention to take advantage of it.”

The provisions are similar in Belgian and French law: a person (the stipulator) obtains a promise from another (the promisor) to perform an undertaking for another person (the beneficiary), with or without remuneration.

Within the context of life assurance contracts, the stipulator is the policyholder, the promisor is the insurance company and the beneficiaries are the designated beneficiaries.

It is therefore particularly important not only to write a beneficiary clause, but to write it with sufficient care to ensure that it meets the client’s needs!

- When should you write a beneficiary clause?

The beneficiary clause may be written when entering into the life assurance contract or later on. It may also be amended at any time before the death of the insured person.

Yet it is much more practical for the policyholder to write it when entering into the contract, or even to adopt a standard clause that may be amended at a later date.

- How should you write the beneficiary clause?

A beneficiary clause must be written with care, failing which the estate and succession objectives of the client will not be met. The client’s advisor therefore has an important responsibility when advising the client at the time of entering into the contract and when the beneficiary clause is being written.

The experts at OneLife are available to their clients and partners to help them write this central clause of the life assurance contract.

- Who can be designated as a beneficiary of a life assurance contract?

Significant freedom applies to the designation of beneficiary; any natural person (partner, children, grandchildren, etc.) or legal entity (charity, company, etc.) may be designated as a beneficiary of the life assurance contract.

Just a few exceptions apply to this extensive freedom of designation, notably:

– An animal may not be a beneficiary (shame for Choupette, Karl Lagerfeld’s cat), which is a prohibited practice in France and Belgium, but permissible in Germany and the USA (Bubbles, Michael Jackson’s chimpanzee, is credited with a personal fortune of 2 million dollars!), yet it is not prohibited to designate a person responsible for looking after the animal and, for Karl Lagerfeld, of using his German nationality to make a will governed by German law!

– Prohibition on designating your doctor, adult protection officer or minister of religion under Article 909 of the French and Belgian civil codes.

– Provisions concerning manifestly inflated premiums which would deprive the heirs, notably the rightful heirs, of their inheritance rights.

- What advice should be taken into consideration when writing the beneficiary clause?

There are 3 types of beneficiary clause, each with its own specific advantages:

a. The standard beneficiary clause

b. The special beneficiary clause

c. The divided beneficiary clause

a. The standard beneficiary clause

The standard clause meets the needs of most clients in terms of estate and succession planning.

It provides for:

- Protection for the partner in the first instance in the event of death;

- Then, if the partner has died or is divorced, transfer of assets to their children;

- Terms of representation;

- And finally, if no beneficiary can be identified, transfer to the legal heirs alongside the benefits of the life assurance policy.

However, several points are worthy of note:

- The beneficiaries must be identified (i.e. named) or identifiable (a category is defined but the beneficiaries are not designated by name), the writer must avoid naming a person and their status (“my wife Marie-Hélène Martin”). If a partner loses or changes their status, a conflict could emerge regarding the identity of the beneficiary!

The writer may nevertheless designate the beneficiary by name but it is recommended to state their full name, address, date of birth and the family relationship between the writer and the beneficiary for ease of identification purposes, thereby shortening the time required for benefits to be paid.

- The clause may be incorporated within the assurance contract, or may also be deposited with a notary.

- Beneficiaries do not actually have to exist or be identified when writing the clause, but must simply be identifiable. In other words, it is entirely possible to designate a category of people yet to enjoy the specified status at the time of designation. Identification will be made when the due amounts are paid out.

For example, Abra Racourcix names his wife as first-ranking beneficiary (not divorced or legally separated).

When writing the clause, the person in question was the elegant Bonnemine. However, later in life Abra Racourcix meets the beautiful Falbala, gets divorced and remarries with her.

By adopting the designation of status as spouse, Abra Racourcix will not need to modify the clause when he gets divorced from Bonnemine, with Falbala naturally and automatically becoming beneficiary.

He also designated his current or future children, living or represented. Abra Racourcix did not have any children with Bonnemine when writing the beneficiary clause, but when the capital was paid out he had one child with Bonnemine (Tournedix) and one with Falbala (Multirix).

- Specify the respective shares of each beneficiary, for example, either for the total amount in equal shares or by using percentages.

- Check the compatibility of the beneficiary clause with the matrimonial regime of the policyholder(s).

- Verify that the clause is precise and complete to avoid any difficulties of identification or interpretation on payment day.

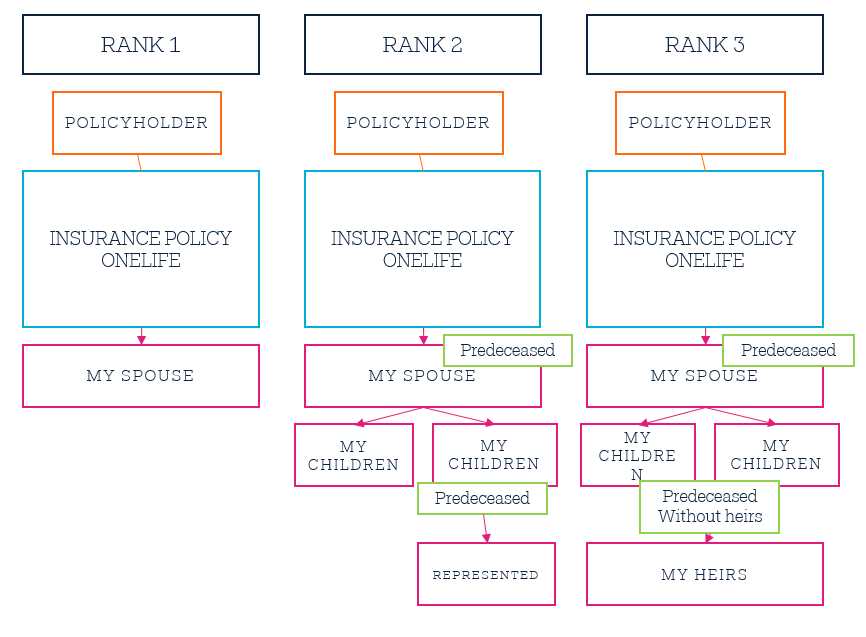

- Allow for several ranks of beneficiaries to avoid reincorporation within the estate and all the negative civil and tax consequences, separated by the term “failing which” to specify each rank of beneficiaries who can then enjoy the benefits by taking advantage of the life assurance allowances in proportion to their shares in the estate. Specifying heirs is also preferable to legal heirs, as the latter status does not specify the rights of potential heirs under the will.

- Allow for representation! This is not an entitlement unlike succession law and must therefore be expressly provided for in order to bring about its full effects! To which specific situation does it apply?

In the case of Abra Racourcix, for example, in his beneficiary clause he clearly stipulated “my current or future children, living or represented”. Accordingly, in the event of the predecease of a child, their share will automatically go to their own children!

The possible relinquishment of a child must be allowed for, in which case the standard beneficiary clause must be written as follows:

First Rank: “My spouse or partner, not divorced or legally separated, for the totality of the benefits of the contract.”

Second Rank: “Failing this, my current or future children, living or represented. In the event of relinquishment by any thereof, the corresponding share shall go to their own children.”

Third Rank: “Failing this, my heirs.”

b. The special beneficiary clauses

b. The special beneficiary clauses

In addition to the standard clause, and having understood its principles, a large number of variations of the beneficiary clause are possible, whether a clause benefiting a member of the family or a third party, or a clause used to serve as a guarantee (see our article on collaterising the life assurance contract https://www.onelife.com/blog/pledging-life-insurance-policies-as-security/), or providing for options such as:

- Receiving all the capital or a percentage

- Receiving in full ownership or usufruct

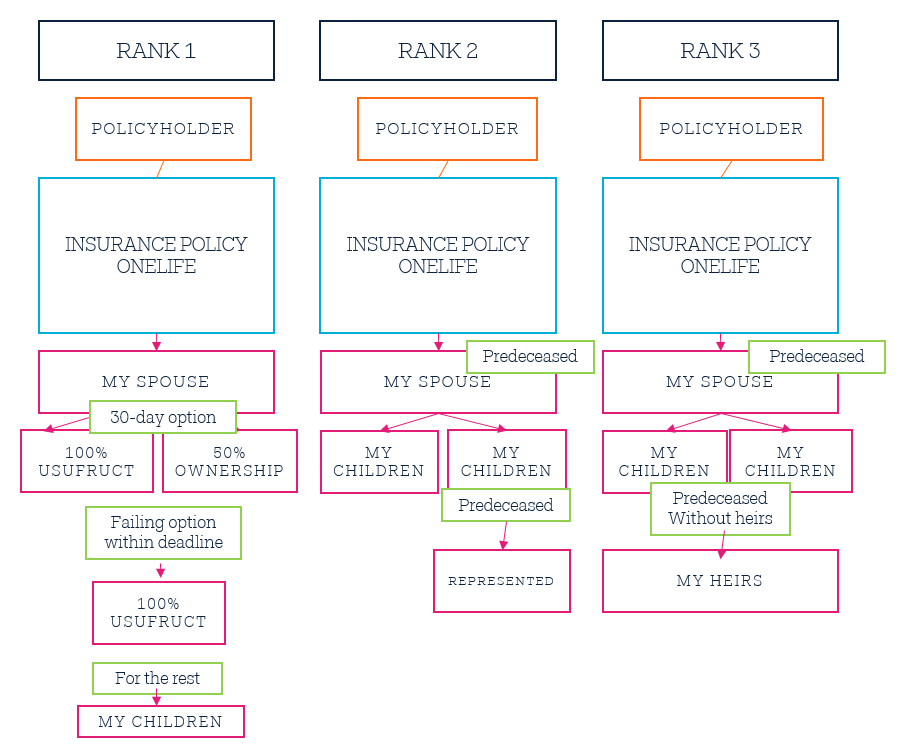

It is possible to provide for the beneficiary having the option of receiving the full ownership or the usufruct of the capital paid out. But what does this cover?

In both French and Belgian law, property rights break down into 3 distinct rights, emanating from Roman law:

- Usus, i.e. the right to use the thing in question

- Fructus, i.e. the right to enjoy the good in question, to draw its benefits and income

- Abusus, i.e. the right to alienate or sell the thing in question

In a similar way as in the case of donation, it is possible to provide one person with the rights of usufruct (usus rights + fructus rights) over the capital, and another with the bare ownership (abusus rights) over the capital.

A beneficiary clause combining these different options is also possible:

First Rank: time-limited option for the beneficiary spouse over the totality in usufruct or 50% in full ownership.

“Option within 30 days of death, for my spouse or partner, not divorced or legally separated, between the usufruct of all the capital paid out or the full ownership of 50% thereof, where the rest shall go to my current or future children, living or represented; in the event of relinquishment by any thereof, their share shall go to their own children. Failing an option being exercised within 30 days of death, my spouse or civil partner, not divorced or legally separated, for the usufruct of all the capital paid out.”

Second Rank:

“Failing this, my current or future children, living or represented. In the event of relinquishment by any thereof, the corresponding share shall go their own children.”

Third Rank:

“Failing this, my heirs.”

The option is time limited to enable a tax return and settlement of any amounts due to be made with regard to the tax authorities.

c. The divided beneficiary clause

c. The divided beneficiary clause

A third possibility exists although much rarer in practice, as particular attention must be made not only to its wording, but also to the civil and tax implications of such a clause: the divided beneficiary clause.

Division is common practice within the context of donations and real estate but less common for sums of money, although the principles are identical:

- The usufructuary receives (for a fixed duration or otherwise) the right to use the capital and receive its benefits. The usufructuary may use and spend the capital, with the sole obligation of paying back an equivalent amount on conclusion of the division.

- The bare owner only holds a claim vis-à-vis the usufructuary, i.e. the usufructuary is indebted vis-à-vis the bare owner in the amount of the sum provided, but only on conclusion of the division!

However, the tax implications are not insignificant and must be taken into consideration with the utmost care when establishing the wording of the clause, notably the potential application of death duties and income tax relating to life assurance contracts in France.

The tax burden must be spread out to ensure that the bare owners, who only hold a claim, are not required to pay the related tax immediately, and there also exists the risk of the capital being dissipated by the usufructuary to the detriment of the bare owners. Such factors can lead to family conflict.

- Which types of beneficiary clause should be avoided?

The client’s advisors and insurers are under a particular responsibility in terms of providing advisory services, notably when writing the beneficiary clause! The astute advisor will therefore avoid the following clauses:

- Clauses including names without further precision, e.g. Bernard Martin and Geoffroy Peeters

- Clauses including broad and non-specific categories, e.g. my neighbours, my colleagues, etc.

- Clauses providing for specific amounts being allocated to each beneficiary, whereas the underlying value of the contract is likely to fluctuate over time, e.g. €5,000 for Françoise, €6,000 for Martin, etc.

- Imprecise or inexact clauses (absence of representation of children, shares not totalling 100% of the capital to be paid out, etc.), e.g. 40% for Martin, 20% for Jeanne, 50% for Bert…

Would you like more information? OneLife’s experts are here to help plan your or your clients’ wealth and estate.

![]() Jean-Nicolas GRANDHAYE, Corporate Counsel at OneLife

Jean-Nicolas GRANDHAYE, Corporate Counsel at OneLife