September 25, 2018

In the world of a High-Net-Worth Individual (HNWI), there are many things that can be complicated -wealth and succession planning, managing tax across multiple jurisdictions and navigating a cross-border lifestyle, to name a few. However, investing in non-traditional assets doesn’t have to be complex, despite sounding it!

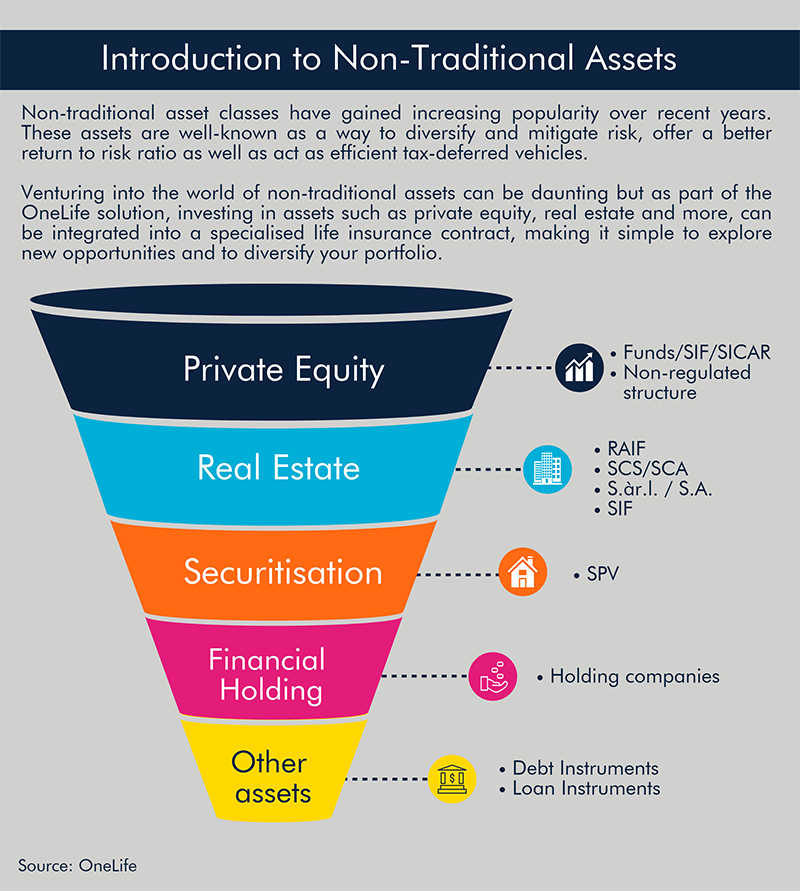

With the OneLife solution, non-traditional assets can be integrated into your life assurance contract – covering investments within Private Equity, Real Estate, Securitisation, Financial Holdings, as well as managing the transfer of wealth between generations.

*SIF = Specialised Investment Fund

RAIF = Reserved Alternative Investment Fund

SCS = Sociétés en commandite simple / Common Limited Partnerships

SCA = Sociétés en commandite par actions / Corporate Partnerships Limited by SharesS.àr.l. = Société à responsabilité limitée / Private Limited Companies

S.A. = Société anonyme / Public companies limited by shares

With the high levels of customisation and flexibility that a Luxembourg life assurance policy provides, at OneLife we work with you to find the investment solution which best suits you. The one that helps you to unlock potential for growth and diversify your portfolio – all within the safe and secure framework of Luxembourg life assurance.

Non-traditional investments may also be combined with traditional ones, giving you the opportunity to take advantage of a wide range of asset classes. And if you decide to relocate one or even several times, the portability of your policy makes it possible to meet all cross-border requirements. So if you want to pass on wealth to the next generation just as you want to, make it grow while keeping it safe, live a mobile lifestyle – a life assurance policy from OneLife is the ideal solution!

Interesting in learning more about investing in non-traditional assets? Check out this => link!