September 28, 2016

Albert Einstein. A human being whose neurological connections moved at the speed of lightning. Yet in a moment of brilliant and unforgiving honesty, he once exclaimed – “The hardest thing in the world to understand is the income tax.”

We are quite certain many would agree. The puzzlement in finding appropriate tax structures has been a concern for decades, and in fact, results from our ‘Essential Wealth: The interplay between self and society’ report proved this.

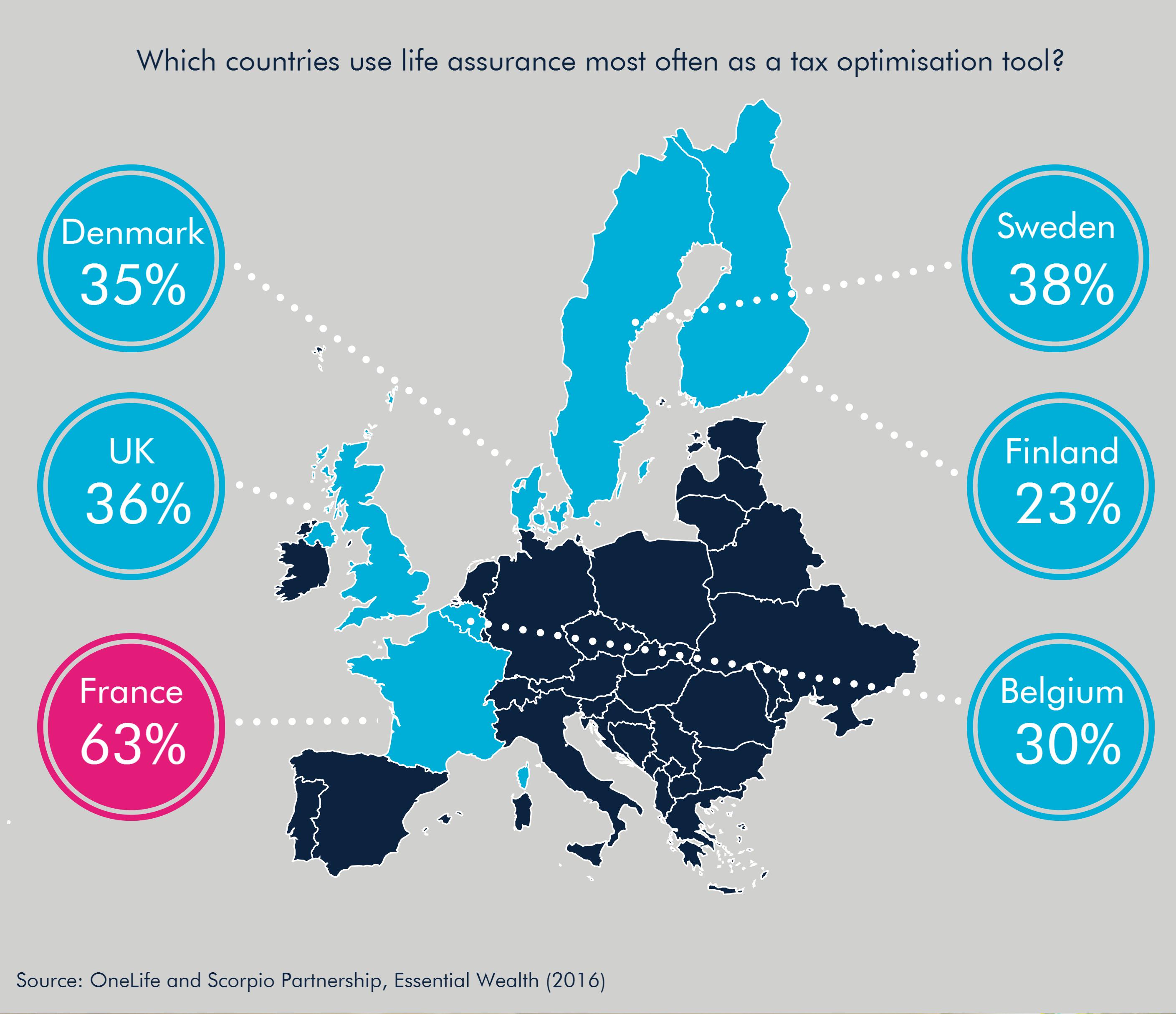

Broadly, the European wealthy tend to consider financial products for reasons other than tax optimisation. The French are the disruptors in this case however – we found that 63% of French HNWIs have a life assurance contract in order to be more tax efficient. But these solutions are tools with high potential, not only in France, but globally, due to the benefits they can reap when it comes to succession planning, portability, and investments.

And as HNWIs become an increasingly mobile clientele, competition in the industry is expanding from being purely domestic to much more international. Inevitably, some key financial centres are emerging as key players in the wealth management space.

Luxembourg being one of them, has developed a core presence in the life assurance market.

Read more about the wealthy and how they feel about tax in our latest thought leadership paper below.