May 19, 2023

Wealth planning is understood as organising and planning the transfer of a given asset, while trying to optimise the taxation applicable at each stage of this process. Life assurance undoubtedly has a major advantage in one of the stages of any wealth planning, namely the pure and simple holding of movable assets invested in a product whose direct taxation remains very advantageous to this day in Belgium.

However, prior to this holding fase and therefore to any investment, the structure of a life assurance policy will have to be addressed, and, inevitably, the detailed personal situation of the client-investors concerned. This includes the determination of the estate available to each client, the rates applicable to any transfer of assets during the lifetime of the client or on the grounds of deathand, last but not least, the validity of the techniques used in estate planning.

Nature of the relationship between individuals in a couple

Let’s take the typical example of a couple wishing to make an investment, with the aim of protecting the surviving spouse. The nature of the relationship between these individuals will primarily determine the legal protection (in terms of the surviving spouse’s “rights” to the deceased’s estate), as well as the applicable tax rates. Once this relationship has been determined, the appropriate technique can be applied to favour the spouse and to optimise the tax implications of any planned estate transfer. Several hypotheses can be considered:

- Marriage: this first hypothesis, which is still the most common today, is not necessarily the easiest to understand, since within a marriage several agreements in terms of asset division are possible. Indeed, marriage is a union that can be preceded by a marriage contract, but is equally possible without a marriage contract. Moreover, the contract does not necessarily imply a pure and simple separation of goods and, for the record, a universal community of goods is also considered as a marriage contract in itself.

- Legal cohabitation: this allows two individuals to be assimilated to married couples, while benefiting (basically) from a fairly clear separation of assets. Legal cohabitation requires a declaration of cohabitation to the municipality where the family home is situated. This declaration gives rise to an inheritance right in the cohabitants concerning the usufruct of the family home.

- De facto cohabitation: this is deduced from the registration in the population registers of two individuals at the same address. Under certain specific conditions (Belgian regional jurisdiction) de facto cohabitants can then claim assimilation to a married couple as regards the applicable rates. The law does not grant any inheritance rights to a de facto

- Finally, the absence of any connection leads to the conclusion that the two individuals are ‘third parties’ to each other. This qualification leads to the application of the highest rates of gift/inheritance tax, as well as the absence of any inheritance rights.

Impact of a matrimonial regime

Since a regime of separation of goods seems easier to understand, particular attention will be paid to the still very common so-called “legal” regime. This regime is adopted by default if the spouses have not signed a marriage contract beforehand, or if, for example, the provisions contained in a marriage contract are inconsistent and incomplete.

Importance of the nature of invested assets

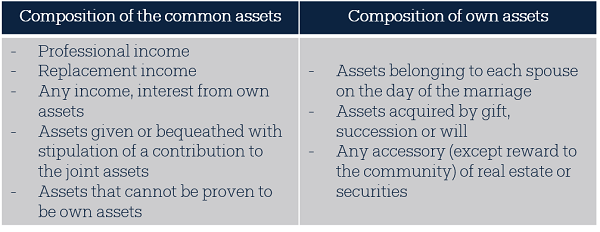

In the context of any estate planning, it is important to consider the nature of the assets used in the implementation of a particular technique (donation, accretion clause, civil reward mechanism, etc.). Specificities are to be noted in the context of the legal regime. In view of the presence of three assets, the following (non-exhaustive) list will help determining more precisely the content of each of these assets:

Practical case: the spouses wish to make an investment and guarantee protection for the surviving spouse. To this end, they are offered a joint application to a life assurance policy with the formulation of an accretion clause. The two spouses, married under the legal regime, invest in equal shares in this policy in joint ownership, using rental income (obtained during the marriage) from real estate they owned on the day of the marriage.

- Unfortunately, the technique envisaged will not be effective in this case, since the income from own property is considered as common property under the civil law governing the legal regime. Consequently, any optimisation sought (fiscal or even civil, as the object of an increase is not part of the estate referred to in Article 4.153 of the Civil Code) is nullified.

- On the other hand, if each of the spouses had sold the real estate and then invested it in the same way, the sale price replacing the real estate remains considered as own

Conclusion

A case-by-case analysis is therefore decisive for the validity of the envisaged estate planning technique, with particular attention to :

- the nature of the relationship between the individuals in a couple

- their matrimonial regime

- the nature of the assets they wish to invest

=> In view of the notarial formalism involved in many asset transactions, it is therefore strongly recommended that any analysis of a client’s personal asset situation should refer to a notarial deed to ascertain the nature of the assets invested in a life assurance solution.

Want to know more about opportunities offered by Luxembourg life assurance?

![]() Nicolas Milos

Nicolas Milos

External Legal Counsel of OneLife, specialised in Estate Planning