October 28, 2019

Life assurance is the bedrock of any person’s financial plan, ensuring that assets are safeguarded and family members protected. Luxembourg’s ‘Triangle of Security’ system is designed as a gold standard for investor protection, and part of the country’s broader ‘protection for all’ principle.

The legal framework of Luxembourg’s life insurance sector incorporates three key elements:

• The regime protecting policyholders – the Triangle of Security.

• Protection against the bankruptcy of the insurance company.

• Protection against seizure of policy claims by third parties.

Triangle of Security

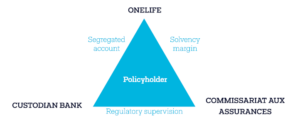

The Triangle of Security has been the foundation of Luxembourg’s position as a leading European centre for life insurance. It is a legal mechanism designed to protect the policyholder, creating strict controls over how their assets can be held and used. It is based on a tri-party deposit agreement signed by the industry regulator, the Commissariat aux Assurances, the life insurance company and the custodian bank – the three sides of the Triangle.

• The insurer must deposit all the assets linked to life assurance polices with an independent custodian bank. Policyholder assets must be segregated from those of the insurance company and of the bank itself.

• The regulator approves the custodian bank, and has powers of oversight, investigation and sanctions – including the power to freeze the assets of a life insurance company if it identifies a significant risk.

Protection against the insurer’s bankruptcy

If the insurance company runs into financial problems, the CAA may use its powers to protect policyholders from loss, for example by freezing the segregated accounts of policyholders and beneficiaries. This means no further transactions may be carried out involving the accounts without the regulator’s authorisation. It may also sell liquid assets or register a mortgage on fixed assets.

Policyholders enjoy a so-called Super Privilege – first-rank preferential rights over the assets held in separate accounts, giving them priority over all other creditors of the insurance company.

If there aren’t sufficient assets in the separate accounts, policyholders have additional privileged rights over the insurance company’s own assets – but only after legal and liquidation costs, employees’ claims and accident liabilities, plus those of the government and local authorities.

Protection against the seizure of policy claims by third parties

The rights to redeem, advance and pledge the policy belong exclusively to the policyholder and cannot be seized by a third-party creditor. If a policyholder has an unpaid debt, the creditor cannot seize the policy or force the holder to redeem it.

While policyholders’ creditors may seek redress from the insurance company to recover their claim, they will receive no payment unless the policyholder freely decides to redeem the policy.

Strengthening of the protection framework

This fundamental framework has recently been tightened even further with new rules that align protection with the policyholder’s risk profile and investment strategy. Whereas under the previous regime policyholders were treated equally regardless of whether they opted for a high-risk/high-return or a conservative investment strategy, now each policy is considered as an individual cell on which the super privilege is exercised, rather than the pool of all policyholder assets.

The changes illustrate how the authorities strive continually to ensure the maximum protection for Luxembourg life insurance clients. After all, life insurance is about Security and peace of mind whatever the future holds.

Key points:

• Luxembourg’s Triangle of Security is designed as a gold standard for investor protection in Europe.

• The regulatory framework provides protection against the bankruptcy of the insurance company and against claims laid against the policyholder by third parties.

• Under new rules, protection is personalised according to the policyholder’s profile and strategy.

To find out more, watch this video and consult our factsheet.