March 13, 2019

Your business as an insurance intermediary is growing and you are considering selling OneLife’s insurance products outside your home market? To meet the needs of your increasingly mobile customers, you intend expanding into foreign markets? What are the opportunities open to you?

The situation as you understand it:

The business of insurance distribution (formerly insurance mediation) is highly regulated. Any insurance broker or agent must be authorised by the regulatory and supervisory authority before carrying on its activities. Once an insurance broker is authorised, it possesses a European passport (since the third life assurance directive of 10 November 1992), enabling it to conduct business in another European Union member state without being established in that state by way of the freedom to provide services. This means that the broker does not have to have a permanent establishment to provide services to customers outside the member state in which it is established.

It is this freedom to provide services that enables OneLife to offer its Luxembourg life assurance products in the European Union.

However, like insurance intermediaries, OneLife must first respect certain conditions before being able to pursue business in another Member Sate of the European Economic Area (EEA).

What you might not have known:

The two freedoms that allow insurance products to be distributed abroad are the freedom of establishment and the freedom to provide services, each of which has its advantages and drawbacks. Here is a brief presentation of these two freedoms.

1. Freedom to provide services

1. Freedom to provide services

If you are registered with the FSMA (Financial Services and Markets Authority) in Belgium, the Luxembourg insurance commissioner (Commissariat aux Assurances – CAA) or the French register of insurance intermediaries (Organisme pour le Registre des Intermédiaires en assurance – ORIAS), then you possess the European passport. In order to sell insurance products in a market (Member State) other than the market in which you are established, you can choose to pursue your business in this other market by way of the freedom to provide services.

For example, for a French intermediary, articles L 515-1 et seq. of the French Insurance Code governs the procedure to follow in order to apply for an authorisation extension with respect to a foreign market:

- Any (re)insurance intermediary or any insurance intermediary distributing insurance as an ancillary activity registered in France that intends pursuing business for the first time in another Member State under the freedom to provide services must first send the following information to the body that maintains the register mentioned in I of article L. 512-1 (ORIAS):

1° Its name, address and registration number;

2° The Member State(s) in which it intends pursuing its business;

3° The category of intermediaries in respect of which it intends to pursue its business and, where applicable, the name of any (re)insurance company it represents;

4° The branches of insurance concerned, if any.

II – Within one month of receiving this information, the body that maintains the register mentioned in 1 of article L. 512-1 communicates the information mentioned in I to the host Member State’s supervisor. The aforementioned body then informs the (re)insurance intermediary or insurance intermediary distributing insurance as an ancillary activity that the host Member State’s supervisor has received this information and that it can begin to carry on its activity in that State. Where applicable, at the same time, the body informs the intermediary that the information concerning the rules protecting the general good applying to the activity intended to be conducted in the host Member State are published by this State, and that the intermediary must respect these rules in order to pursue its business there.

The Luxembourg law on the insurance sector in its articles 293 and 293-1, and article 269 of the Belgian law of 4 April 2014 on insurance prescribes the same conditions:

Extract from Article 269 of the law of 4 April 2014:

- Any (re)insurance intermediary or insurance intermediary distributing insurance as an ancillary activity registered in Belgium that intends pursing its business in Belgium for the first time in another Member State by virtue of the freedom to provide services must first inform the FSMA in the form and conditions the FSMA has prescribed.

Within one month of receiving the information referred to in paragraph 1, the FSMA communicates the information to the host Member State’s supervisor.

After the host Member State has confirmed receipt of the information, the FSMA informs in writing the intermediary concerned that it has received the information and that the intermediary may begin conducting its activities.

When pursuing its business in the host Member State, the (re)insurance intermediary or insurance intermediary distributing insurance as an ancillary activity referred to in paragraph 1 must comply with the laws and regulations of this host Member State applying to (re)insurance intermediaries or insurance intermediaries distributing insurance as an ancillary activity in the interests of the general good. The FSMA informs the intermediary concerned where it can find the relevant host Member State’s rules of general good.

The register specifies in which Member States the intermediary may operate by virtue of the freedom to provide services.

2. Freedom of establishment

The freedom of establishment is the right for any authorised person to set up undertakings in another EU Member State. That is to say, an authorised intermediary may establish a permanent presence by setting up a branch or office (permanent establishment) in another Member State subject to respecting the particular procedure as prescribed by article L 515-3 of the French Insurance Code, article 291 of the Luxembourg law on the insurance sector and article 270 of the Belgian law on insurance.

However, this does not concern the creation of a subsidiary (a company) in another Member State, which must obtain specific authorisation from the host State’s supervisor in order to pursue its business of insurance distribution.

The prescribed procedure is similar in the 3 countries.

Extract from article L 515-3 of the French Insurance Code:

- Any (re)insurance intermediary or any insurance intermediary distributing insurance as an ancillary activity registered in France that intends establishing a branch or permanent presence in another Member State under the freedom of establishment must first inform the body that maintains the register mentioned in I of article L. 512-1 and send the following information to that body:

1° Its name, address and registration number;

2° The Member State in which it intends establishing a branch or permanent presence in another legal form;

3° The category of intermediaries in respect of which it intends to pursue its business and, where applicable, the name of any (re)insurance company it represents;

4° The branches of insurance concerned, if any;

5° The address, in the host Member State, for any correspondence concerning the communication of documents;

6° The name of any person responsible for managing the branch or permanent presence.

II – Unless the body that maintains the register mentioned in I of article L. 512-1 has reasons to doubt the appropriateness of the organisation structure or financial position of the (re)insurance intermediary or insurance intermediary distributing insurance as an ancillary activity compared with the intended distribution activities, it sends, within one month of receiving it, the information mentioned in I to the host Member State’s supervisor, which confirms receipt thereof. The aforementioned body then informs the (re)insurance intermediary or insurance intermediary distributing insurance as an ancillary activity that the host Member State’s supervisor has received this information.

Within one month of receiving this information, the body that maintains the register mentioned in 1 of article L. 512-1 receives, from the host Member State’s supervisor, communication of the rules of general good applying in this State. The aforementioned body then informs the intermediary that it can commence to carry on its activity in the host Member State, provided it complies with these rules. If the (re)insurance intermediary or insurance intermediary distributing insurance as an ancillary activity has not received this information by the aforementioned deadline, it may establish the branch and begin conducting its activities.

III – Should the body that maintains the register mentioned in article L. 512-1 refuse to send the information mentioned in I to the host Member State’s supervisor, it communicates to the (re)insurance intermediary or insurance intermediary distributing insurance as an ancillary activity, within one month of receiving all the information mentioned in I, the reasons for its refusal.

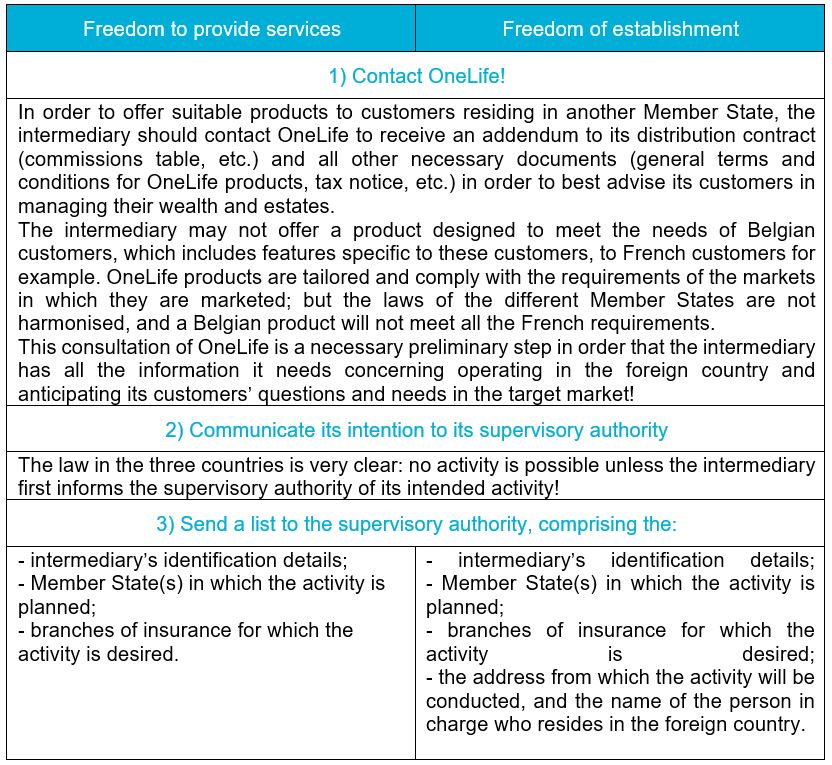

3. For each freedom, the procedure to follow before conducting any activity in another Member State

The intermediary must:

Then, the supervisory authority:

![]()

To sum up:

For the two freedoms, the procedures are clearly similar. However, whereas distributing insurance on a freedom of services basis is less complicated and less expensive than a permanent establishment in another Member State, which requires having a fixed business facility and resident staff, it can be an opportunity to offer services that are closer and more tailored to customers.

Whichever freedom is chosen by way of which the distribution of insurance is to be conducted, the activity cannot begin straight away and the intermediaries are advised to:

- inform OneLife as soon as possible in order to ask them relevant questions;

- anticipate their activity abroad in order to shorten the time spent on the regulatory administrative procedures and to respond to customers’ requests in good time.

You are an insurance intermediary and wish to grow your business abroad? OneLife’s experts are here to help you achieve this goal!

Author:

![]() Jean-Nicolas GRANDHAYE – Corporate Counsel at OneLife

Jean-Nicolas GRANDHAYE – Corporate Counsel at OneLife