January 15, 2018

After a rocky legislative process, Emmanuel Macron’s campaign promise comes with a series of reforms affecting the taxation of movable assets. This is an overview of the new tax landscape in France, including the life assurance regime:

- Objectives and legislative path

Tabled on 27 September 2017 the Finance bill for 2018 presents the far-reaching reforms required by the new president Emmanuel Macron to:

- boost the French economy,

- direct savings towards the financing of the real economy

- simplify and make the tax regime for moveable assets more readable

The bill was discussed at the National Assembly from 17 October to 21 November 2017, and finally adopted at first reading on 21 November 2017. The amended text was submitted to the Senate. As OneLife announced in its article on the subject dated 15 November 2017, the text was met withthe strong opposition of the Senate and was largely amended then submitted to a Joint Commission consisting of National Assembly and Senate members.

Faced with wide dissension within the Joint Committee, the text went back and forth between both chambers. It finally went to the National Assembly, which has the last word for this type of text and which adopted it on 21 December 2017 (subject to the approval of the Constitutional Council after right- and left-wing deputies and senators referred the matte).

The Constitutional Council finally rendered a decision approving the text, which was thus definitively adopted on 28 December 2017 and published in the Official Journal of 30 December 2017.

- Main provisions

The law of 30 December 2017 on the Finance Law for 2018 includes three provisions of particular interest to savers:

- An increase of the CSG rate by 1.7% resulting in an overall increase in social contributions from 15.5% to 17.2%

- The introduction of a 30% flat tax (or PFU – Prélèvement Forfaitaire Unique – in France) on savings income (including social security contributions)

- Replacement of the Solidarity Tax on Wealth (ISF) by the Tax on Real Estate Assets (IFI)

- The PFU: a cure-all for the saver?

PFU is the French term for what is widely known in Great Britain and the United States as a “flat tax”. In France, the PFU is an innovative taxation method by which a uniform rate is applied to a broad category of different situations and sources of income.

The French system usually customises taxation to the individual situation and according to the type of income. This is, therefore, a significant change in the tax approach in Emmanuel Macron’s presidential programme.

The basic idea is to simplify the taxation of the capital of French residents by applying a single rate applicable to a full range of savings accounts, investments and income:

- by applying a single rate to all financial income

- to avoid the complicated application of the income tax for different categories of financial income (life assurance income, interest, dividends, capital gains…)

This apparent simplification actually makes the taxation of financial income more complex, especially as concerns life assurance.

a. Affected policies

The PFU applies to all financial investments held by French residents as at 1 January 2018 and, for life assurance, retroactively from 27 September 2017.

This includes fixed-income investment products, bond coupons and dividends which now see the 40% tax allowance removed unless one opts for dividend taxation by the progressive scale of the French Income Tax (IR).

However, the PFU does not affect:

- Regulated savings accounts (Livret A, Livret de Développement Durable et Solidaire) as well as savings products exempt from income tax (company savings scheme, retirement savings scheme…)

- Investments heavily weighted towards equities such as the equity savings plan (PEA). An exception consistent with one of the government’s goals of promoting investment in the real economy

- Property income, which is nevertheless affected by the proposed wealth tax reform as a real estate tax

Thus, neither life assurance nor bank savings accounts (including the Home Savings Scheme [Plan Epargne Logement] and the Home Savings Account [Compte Epargne Logement], but only those opened as from 1 January 2018) are exempt from the PFU.

b. PFU or the fixed-fee scale of the IR?

The PFU rate is set at 30%, i.e.:

- 2% of social contributions and

- 8% of income tax

In principle, therefore, savings income will be taxed at the rate of 30%, but the investor may want to consider the option of having the progressive scale of the French income tax applied instead!

The option must then be chosen in writing, and the choice is irrevocable and general, i.e. it covers all the income from movable assets of the investor for one year.

As from 1 January 2018, the Prélèvement Forfaitaire Obligatoire (a fixed levy at source equivalent to the rates the PFU, i.e. 17.2% of social contributions and 12.8% of income tax) isdebited from all income from movable assets received by investors. This deduction does not entail full discharge.

- If the option to apply the IR scale is not available, the PFO will entail full discharge. In other words, PFO = PFU.

- If the investor chooses to apply the IR scale, the PFO will be credited to the amount of IR to be paid, with the investor being entitled to a refund in the event there is a surplus.

Low-income individuals in France may want to opt for the application of the IR scale.

- PFU and life assurance

Is the PFU more advantageous than the old applicable taxation anyway?

The government’s initial intention was to limit the application of the PFU to policies taken out on or after 27 September 2017, and to policies taken out before that date but with premiums over €150,000 and €300,000 for a couple, and only for the premiums paid as at 27 September 2017.

Analysts logically deduced that the new regime would be less advantageous than the old one for policies over 8 years old. An amendment has corrected this issue:

- The PFU (30%) applies to all products attached to premiums paid as from 27 September 2017 for policies under 8 years;

- For policies of more than 8 years,

- the rate of 24.7% remains applicable if the amount of the premiums paid on the policyholder’s life assurance policies do not exceed €150,000.

- If the amount of the premiums paid on the policyholder’s life assurance policies exceeds €150,000,

- the rate of the PFU is applicable for the products corresponding to the portion of premiums paid after 27 September 2017,

- The rate of 24.7% is applicable for products corresponding to the portion of premiums paid before 27 September 2017

This share is determined according to the following calculation: Sum of products * ((150,000 – premiums paid before 27 September 2017) / (premium paid as from 27 September 2017)).

This proportional calculation has not, unfortunately, been drafted in the simplest terms for investors. Similarly, while the original bill provided that the threshold to be used was €150,000 for a single person and €300,000 for a couple, the threshold of €300,000 finally disappeared from the law as it was passed.

The €150,000 threshold must, therefore, be taken into account at an individual level only.

However, and fortunately, the allowances of €4,800 and €9,200 for a couple have been preserved for policies held for more than 8 years. Similarly, the option for IR taxation at the progressive rate has been maintained.

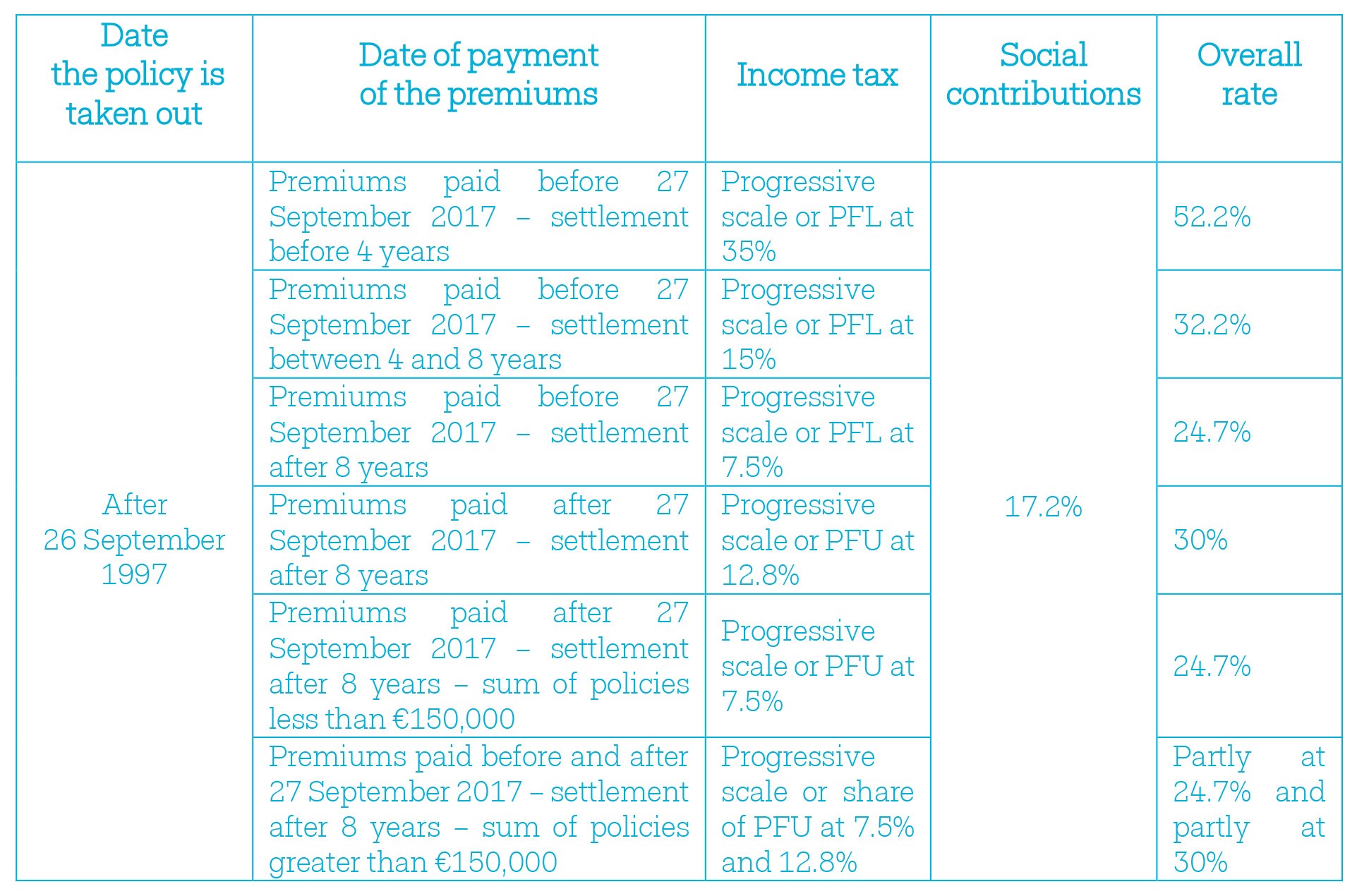

The situation has, therefore, become infinitely more complex and less clear for investors and insurers. This can be summarised as follows:

Click on the table to enlarge it

- The IFI – a gift for the rich?

As from 1 January 2018, the Solidarity Tax on Wealth (ISF) has been transformed into a Tax on Real Estate Assets (IFI).

a. The principle

The ISF traditionally taxed assets of more than €1.3 million by a progressive rate linked to wealth. The principle of the IFI is the same as that of the ISF with the (major) difference that the IFI only taxes real estate assets. Simplification or hoax?

For French residents, the IFI applies to all real estate assets or rights, units or shares of real estate companies held in France and abroad by the persons making up the tax household.

For foreign residents with real estate assets in France, the taxable base for the IFI is as follows:

- The value of real estate assets or rights in held in France by the tax household residing abroad (secondary residence for example)

- Units or shares of real estate companies holding real estate in France

- Units or shares of real estate companies holding real estate in France and abroad, for the respective share of the value of real estate located in France

b. Scope of application

In fact, if your assets are solely composed of real estate assets (principal residence, secondary residence, OPCIs, investment properties, rentals…) and the value of your assets exceeds the €1.3m threshold, the reform will change nothing in your case.

On the other hand, if you hold diversified assets, the IFI will force you to make scholarly calculations between assets within and without the scope. Below is a non-exhaustive list of assets and rights within the IFI scope:

- value of principal residence (however, the 30% allowance has been kept)

- value of secondary residence(s)

- buildings under construction

- undeveloped property (such as land and farmland)

- buildings and fractions of buildings represented by shares of real estate condominium companies

- The usufruct of real estate assets and rights for the total value of the real estate asset or right (except in case of succession, where both the usufructuary and the bare owner may be taxed up to their respective share)

- Shares in companies holding real estate in France, for their value representing the properties held in France directly or indirectly by the company.

It is also possible, in case of doubt about the value of a property, to use the “Patrim” online service made available by the Ministry of Finance: [https://cfspart.impots.gouv.fr/LoginMDP]

Certain real estate assets and rights are not included in the definition of the IFI’s taxable wealth base, and partial or total deductions are available for:

- buildings used for professional activity,

- woods and forests set aside for exploitation or professional use,

- rural properties leased for the long term or for professional use (farmland, buildings and farm equipment),

- furnished housing rented under the loueur en meublé professionnel (professional landlord for furnished accommodation) tax regime.

- the bare ownership of a property that is totally exempt

For foreign residents, the law has also removed the notion of société à prépondérance immobilière française (a predominantly French real estate company) to avoid artificial adaptations (and thus all real estate assets, regardless of how they are held, are included in the tax base of the IFI).

c. Deductions

The IFI is applied to the net taxable assets, i.e. assets net of existing debt as at 1 January of the tax year.

Regrettably, however, many ISF-specific deductions have been done away with (such as family loans and housing tax), and legislators have eliminated the possibility of reducing the tax base via debt.

At least the 30% allowance on the principal residence is still there.

The following expenses, among others, are deductible, provided that one produces the receipts:

- expenses for the acquisition of real estate assets or rights,

- improvement, construction or expansion expenses,

- expenses for the acquisition of units or shares in proportion to the value of real estate assets and rights,

- taxes due on the property concerned (such as property tax).

d. Conclusion

Overall, this tax reform is a step in the right direction as it simplifies, for the future, the applicable rules.

In the short term, however, the new rules add a layer of complexity to the taxation of movable assets by stacking the applicable norms, especially regarding the taxation of dividends and life assurance.

These adjustments render Luxembourg life assurance an even more attractive choice for French residents, and OneLife stands with its clients and partners to guide them through these changes.

Author: ![]() Jean-Nicolas Grandhaye

Jean-Nicolas Grandhaye