April 19, 2017

Two in every three wealthy European millennials are looking to move countries in the next five years.

Which means the modern wealth advisor will need to understand the nuances that impact international wealth. It implies having the right knowledge to take care of their clients’ potential international investments whilst taking into account various jurisdictional differences and associated geographical risks.

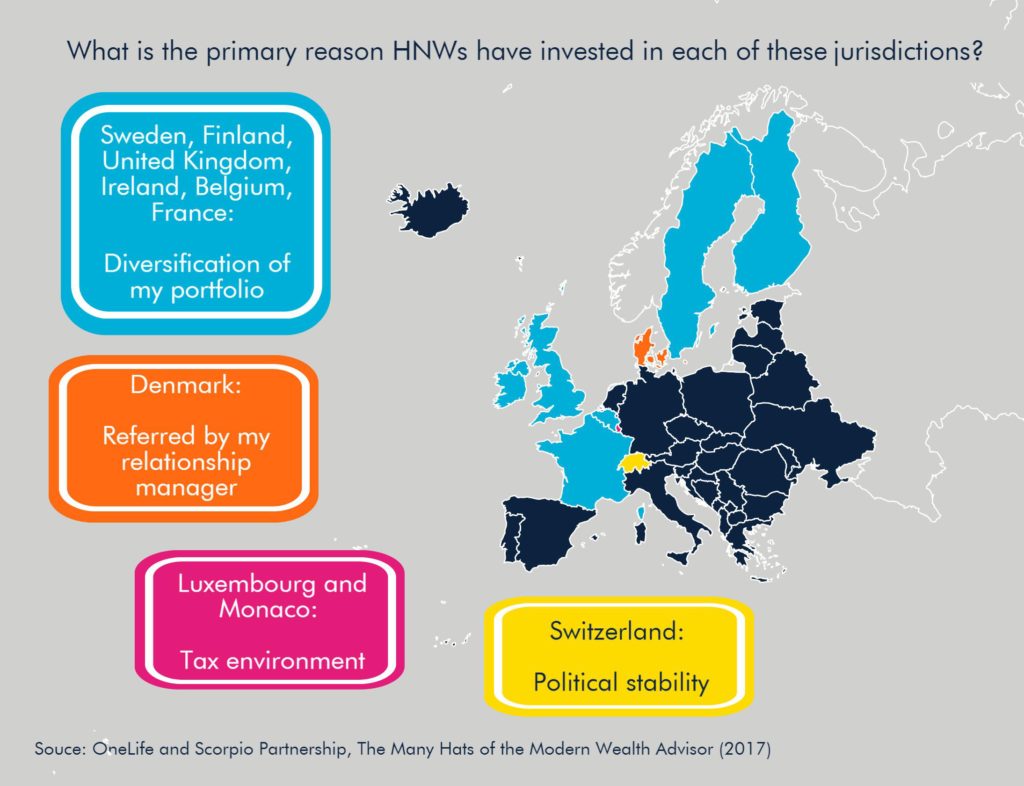

We have identified the features which most attract offshore clients to each market. Staying up to date and remembering to constantly look at things from different angles (or countries), that is to say wearing a Navigator’s hat, puts advisors at an edge to their peers.

Be the Captain they need on this journey. Download ‘The Many Hats of the Modern Wealth Manager’ report.